@realty Network Achieves Over $554 Million in Sales as National Home Prices Reach Record Highs in May

The property market continued its upward momentum in May, with national home prices rising by 0.39%, marking the fifth consecutive month of growth and setting a new record high for Australian property values. This growth aligns with @realty’s own stellar performance, with the network recording an incredible $554,615,285 in property sales across Australia and New Zealand in May alone.

Since the Reserve Bank’s interest rate cut in February, price momentum has accelerated and become more synchronised across the country. All capital cities recorded home value increases in May, reflecting renewed buyer confidence and stronger market sentiment.

National Market Snapshot – May 2025

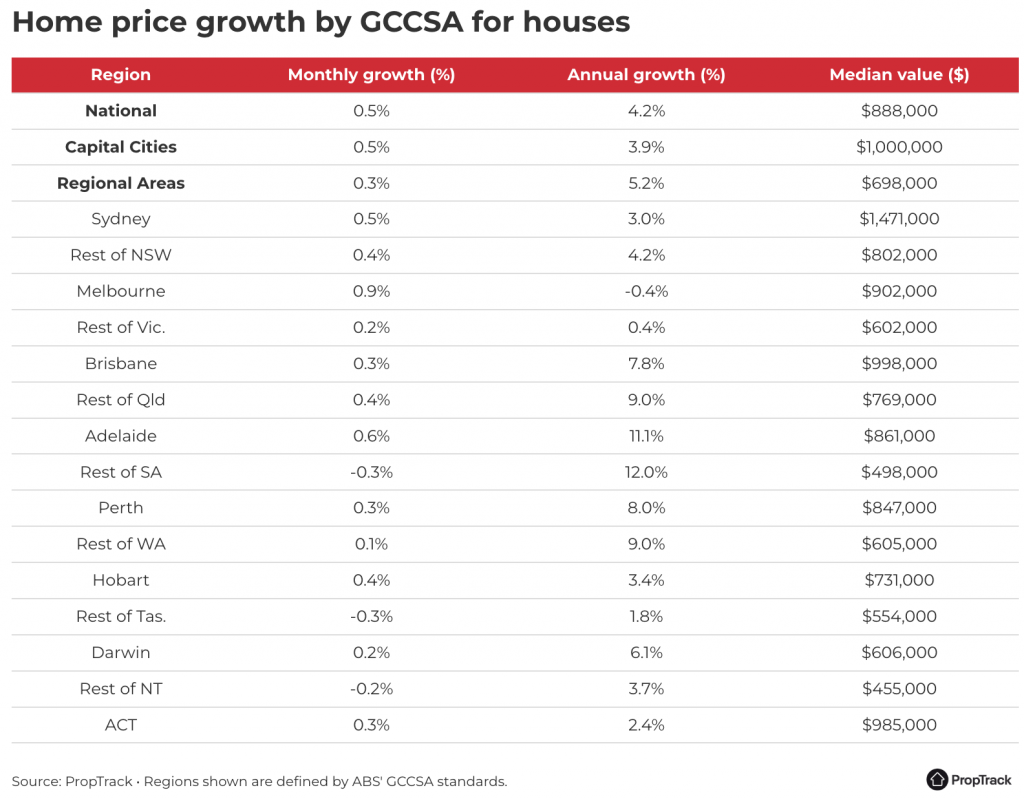

- National home prices rose 0.39% in May and are now 4.12% higher year-on-year.

- Capital cities led the charge, growing 0.45% for the month. Every capital recorded gains, with Sydney, Brisbane, Adelaide, Perth, and Darwin all reaching new price peaks.

- Melbourne posted the strongest monthly increase (+0.79%), though values remain 2.85% below their previous peak.

- In a major shift, Perth’s median home value ($787,000) has now overtaken Melbourne’s ($782,000) for the first time in a decade.

- Adelaide topped annual growth with an impressive +11.04%, followed by Perth (+8.40%) and Brisbane (+8.38%).

- Regional home values rose 0.25% in May and have grown 5.19% annually, outpacing combined capital growth (+3.71%).

@realty’s Strong Performance

The @realty network continues to set benchmarks for excellence in the real estate industry. With over $554 million in sales across Australia and New Zealand in May, the network is outperforming many traditional agencies, driven by innovative technology, flexible work models, and powerful marketing tools. This success reflects the growing confidence and results delivered by @realty agents in capital and regional markets alike.

Capital City Markets See Momentum Converge

The divergence between stronger and weaker markets seen in 2024 is beginning to fade. Markets such as Melbourne and Hobart, which lagged last year, are now rebounding strongly. This convergence highlights improved borrowing power and increased buyer demand following rate cuts earlier this year.

Perth’s rise to overtake Melbourne’s median price is the result of a perfect storm: years of affordability, strong population growth through migration, supply constraints, and a red-hot rental market have all contributed to sustained price pressure.

House vs. Unit Performance

- National house prices rose 0.46% in May and are up 4.23% annually.

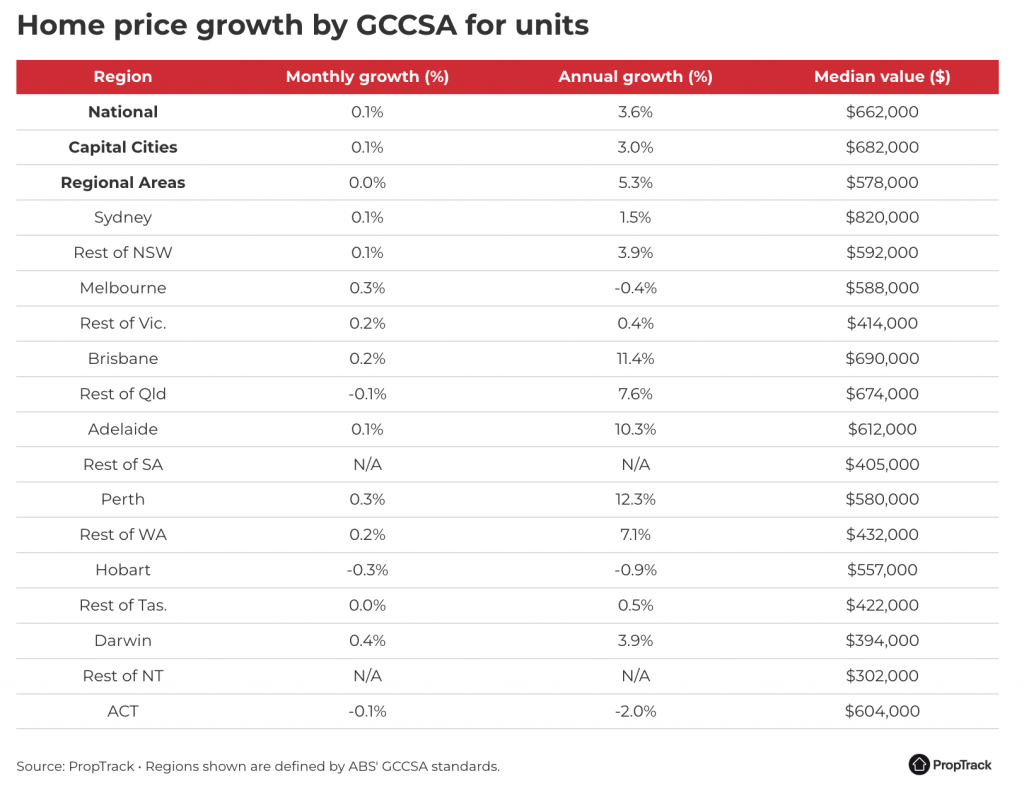

- Unit values lifted just 0.09% for the month, bringing annual growth to 3.58%.

Despite affordability concerns, demand remains strong in Queensland and South Australia, where more accessible price points have lured buyers down the value chain. As incomes lag behind price growth, these more affordable markets are expected to continue outperforming.

Outlook for 2025

With further rate cuts expected, borrowing capacity is likely to increase again, encouraging more buyers to act. A continued shortage of housing supply, population growth, and government incentives are expected to maintain upward pressure on prices throughout the remainder of the year.

While affordability remains a headwind, the fundamentals of the market remain strong. And with real estate groups like @realty delivering record-breaking results, both agents and sellers are well-positioned to capitalise on the ongoing strength in Australia’s property market.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.