House prices have slumped over the past quarter with the biggest falls on record in Sydney, Melbourne, Brisbane and Canberra, leaving prices across all the capitals around $53,000 lower than they were in March this year.

The drops have been so dramatic, according to the latest Domain House Price Report, that house prices in three cities have now even been dragged below what they were this time last year, with Darwin 4.4 per cent down, Sydney 2.8 per cent lower and Melbourne 2 per cent under.

The main culprit, said Domain chief of research and economics Dr Nicola Powell, was the rapid rise in interest rates, which have increased at the fastest rate since 1994.

“The impact on Australia’s housing market became glaringly evident over the September quarter and the downturn has gathered momentum and spread geographically,” she said.

“Many borrowers and potential home buyers will have never experienced anything like this before and, justifiably, it has had a significant impact on consumer sentiment.

“Interest rate hikes and strong inflation levels have damaged borrowing capacity and increased home loan costs, adding an additional $1482 a month to a $1 million home loan. Today’s high household debt heightens the vulnerability of households to rising interest rates and could exacerbate a downturn.”

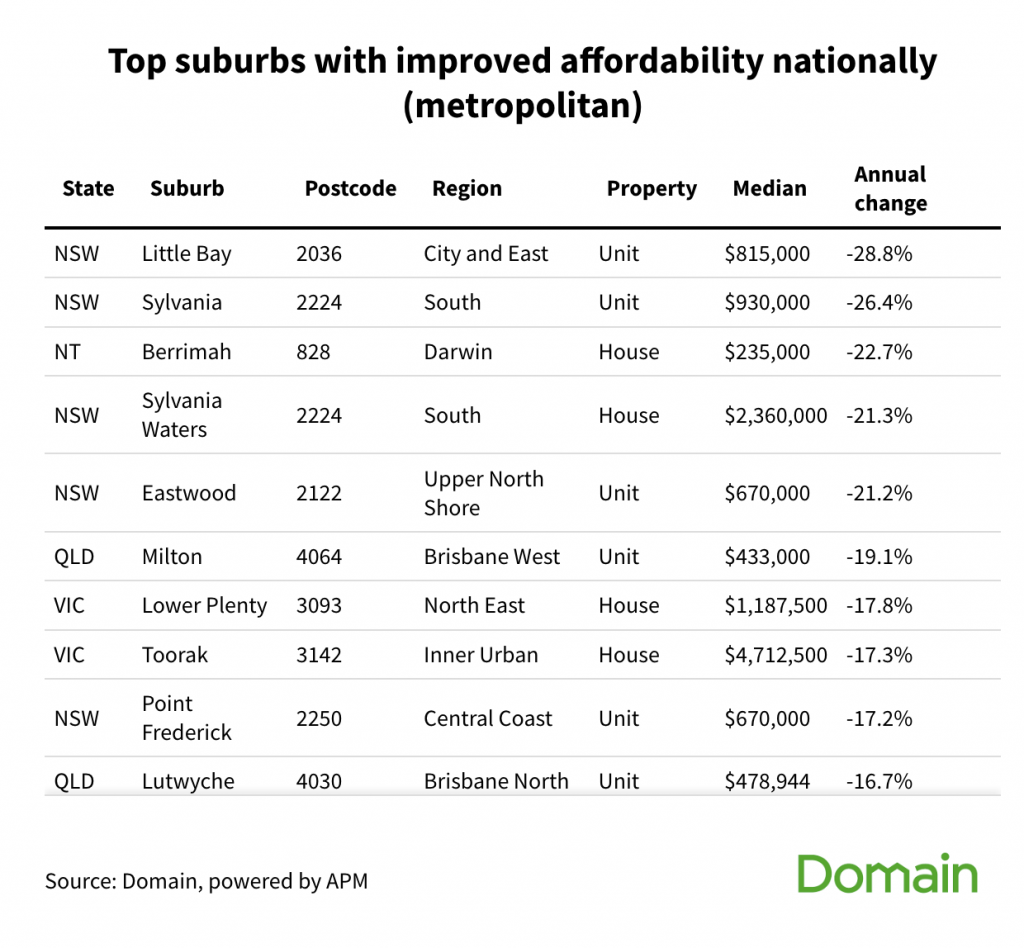

Despite that, however, the news of price falls may be encouraging to buyers, particularly first-home buyers previously locked out of the market by the increasing unaffordability of homes.

At the same time, sellers will be comforted by the thought that prices nationally would have to fall by an additional 21.3 per cent to wipe out the gains they’ve seen over the pandemic price boom.

Powell said although it was likely prices would fall further, she expected this quarter would be the worst of the price falls

“It is likely this quarter will be the peak quarterly decline,” she said. “Rising interest rates still remain a risk to the market, however the eased rate of interest rate hikes from the RBA should help shift the tone among consumers slightly.

“Prospective buyers will be forward planning and pricing in a buffer for further rate hikes and already are more mindful of their lower borrowing capacity.”

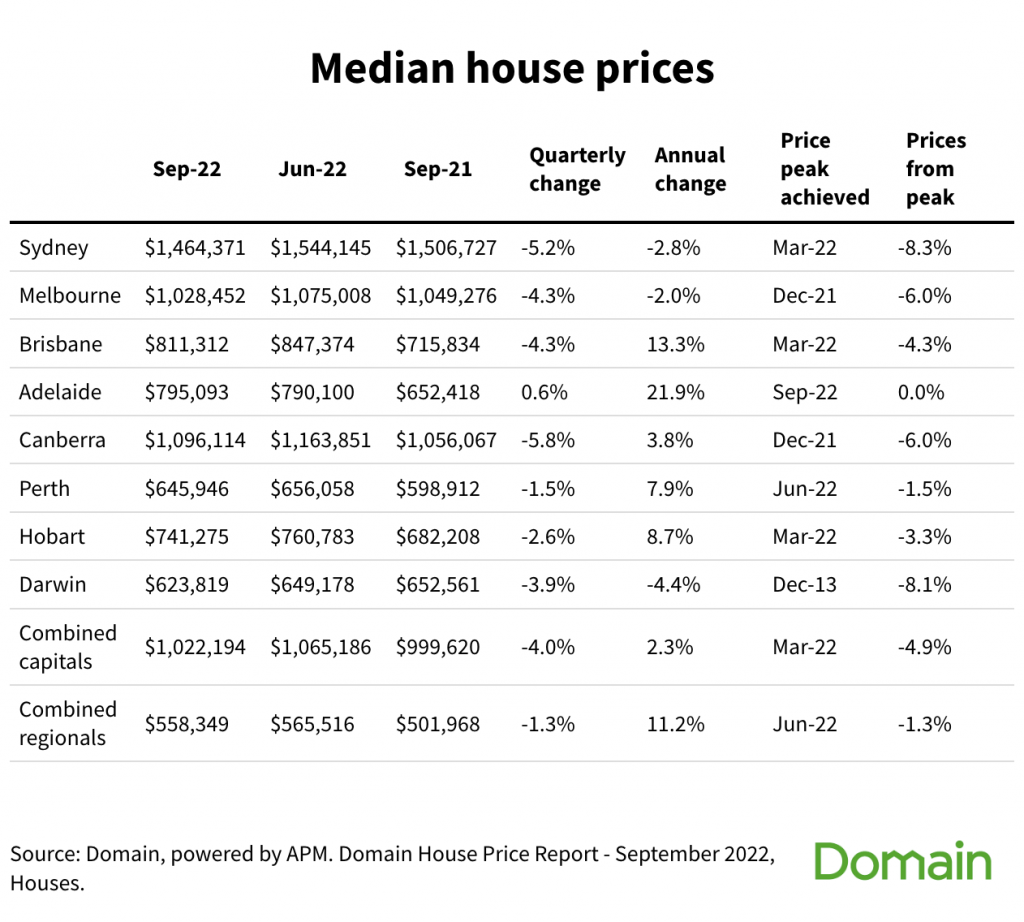

The latest Domain research found that Canberra’s median house price dropped the most over the September quarter by 5.8 per cent to a median of $1,096,000, while Sydney’s fell 5.2 per cent to $1,464,000, and both Melbourne and Brisbane slumped by 4.3 per cent to $1,028,000 and $811,000, respectively.

House prices in Canberra are now 6 per cent – or $70,000 – below their December 2021 peak but are still 29.2 per cent, or $320,000, higher than they were before the pandemic property boom.

In Sydney, house prices are now 8.3 per cent below their March 2022 price peak, down around $132,000, but they’re still 22.3 per cent above what they were pre-COVID.

In Melbourne, they’ve fallen 6 per cent from their December 2021 peak – about $66,000 – but are still up 14.3 per cent from the last two years’ growth.

Brisbane, meanwhile, has seen a 4.3 per cent fall from the top of its market in June 2022, with a drop of $36,000 – although house prices are still 13.3 per cent higher than they were a year ago.

Darwin’s house price dropped 3.9 per cent over the quarter, although it was one of the only two cities, along with Perth, where house prices outperformed units with a 4.9 per cent fall.

Hobart house prices were down by 2.6 per cent, now 3.3 per cent or $25,000 behind the March price peak, and Perth’s fell 1.5 per cent or $10,000 from their June peak in the steepest quarterly decline for house prices.

Only Adelaide has bucked the trend as the sole capital market to record positive house price growth over the quarter, at 0.6 per cent, and reach a new record median high of $795,000.

But its upswing is slowing in what may be an indication that it’s in a traditional time lag behind the other cities’ falls.