The outlook for the Australian property market in 2023 and beyond is uncertain, as the market has transitioned from a once-in-a-generation property boom experienced in 2020-2021 to the adjustment phase of the property cycle that could be best described as multi-speed. After peaking in May 2022, CoreLogic’s national Home Value Index fell -5.3% over the 2022 calendar year, and while overall the Australian property market is in a downturn, not all of the nation’s property markets are being impacted equally.

What’s currently happening to property values?

Each State is at its own stage of the property cycle and within each capital city, there are multiple markets with property values falling in some locations, and stagnant in others and there are still locations where housing values are still rising.

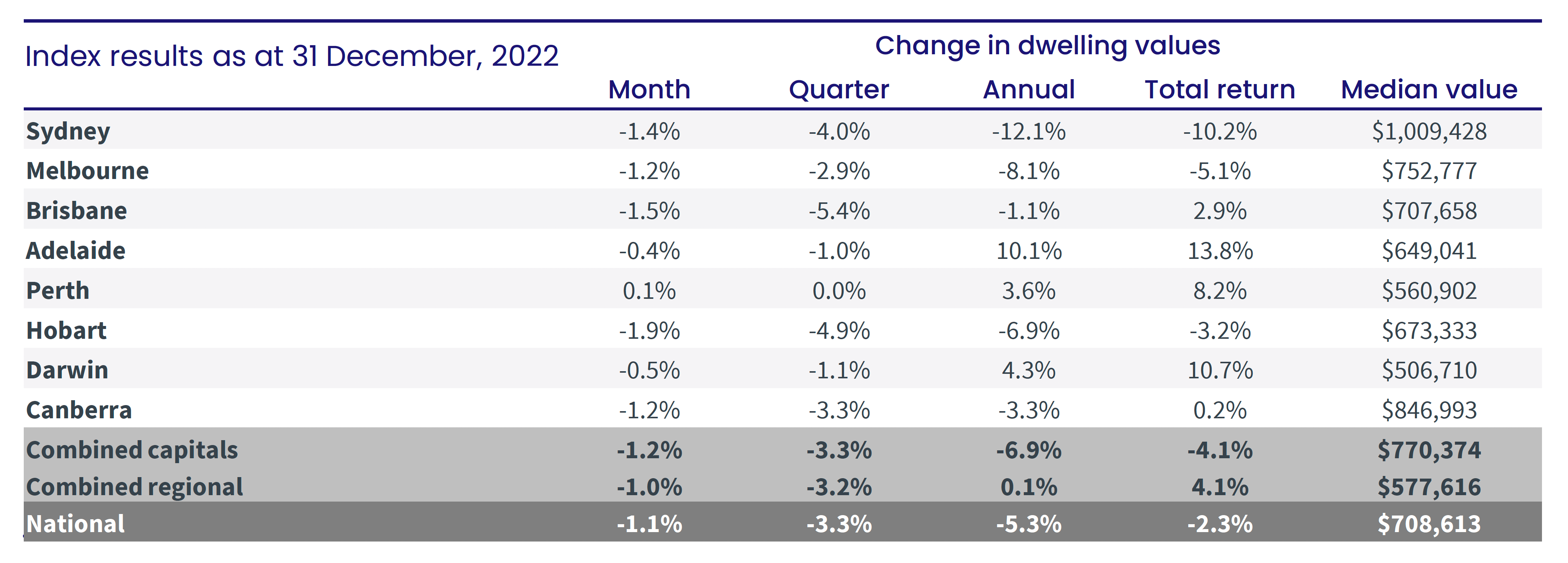

What is currently happening to property values in Australia can be seen in the following table, which shows what happened to dwelling prices around Australia since their peak. As you can see, while values in our capital cities grew considerably, the regional property market performed even better during the last property boom. But now we’re in the adjustment phase of the property cycle and overall property values are 8% lower than their peak.

This is not a property market crash, it is an orderly correction that had to occur after house prices all around Australia got ahead of themselves.

At the same time, we’re experiencing a rental crisis with historically low vacancy rates and rising rents. This is adding to the uncertainty in the market, as potential buyers struggle to find affordable rental options.

Australian housing market predictions

Australian housing market predictions are mixed, with some experts predicting a crash and drastic value drops, while others believe the market will continue to be resilient. You’ve probably also read those forecasts – you know… that property values will fall 20 to 25%. In fact, “Property Prices Will Fall 30%” was a recent headline in the Australian Financial Review by a respected columnist, and here he was not talking about a specific segment of the market, but about “the Australian property market”.

However, such predictions should be taken with a grain of salt, as a fall of this magnitude has never happened before. Not during the recession of the 1990s, not during the global financial crisis, and not during the period of a credit squeeze in 2017-2018. The worst slump in the overall Australian property market was after the credit squeeze on 2016-2017 and when there were concerns around proposed changes to negative gearing before the 2019 election. At that time, the peak-to-trough drop between December 2017 and June 2019 was 9.9%.

Considering the current state of the economy, our financial health and property markets, there’s no credible reason to suggest a fall of this magnitude should happen now. Sure, we’re experiencing a housing market correction – it started at the beginning of the year in Sydney and Melbourne – and is now working its way across the nation, but there will be opportunities for buyers, sellers, and investors alike.